- Capital Contrarian

- Posts

- Private Investments = Generational Weath?

Private Investments = Generational Weath?

More than public, yes

Email agenda:

Estimated read time: 4 minutes 55 seconds

Why Would Elon Musk Want to Take Twitter Private?

How Private Investments Can Make You Rich (cc Tim Ferris)

Avoiding Stocks

Good morning and happy Monday - let's get smarter

Taking a Public Company Private

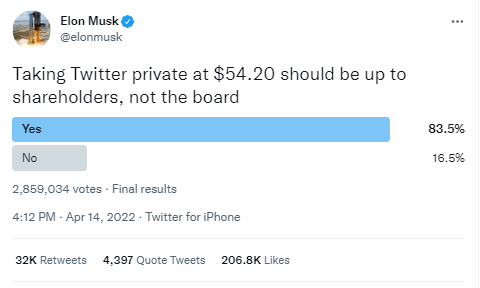

Elon Musk’s text messages were recently in the news about taking Twitter private

Why would Elon want to take Twitter private?

There are quite a few reasons why you'd want to take a company that is public, private

No SEC reporting and public company

If you are public, you have all of the SEC compliance requirements

These are costly and you are required to share your financial performance regularly with the public

Long-term Thinking

Because you have to consistently share your financial performance when you are public, it can lead to short-term focus to try and meet Wall Street expectations

If you miss earnings, you have large price movements in your stock which can misalign management and shareholder interests

Going private allows you to potentially add more value in the long term

One of the major disadvantages of going private is access to capital is more difficult / illiquidity

Past Successes

Michael Dell famously look Dell private in 2013 in order to "be more entrepreneurial and flexible" at $13.73 per share, and then went public again in 2018 at $46 per share, a 70% gain for shareholders

How does it work?

In order to persuade the shareholder's to approve the sale, the buyer has to offer to purchase the shares for more than they are currently trading at on the public market

Additionally, in a private M&A event as opposed to a public event, you are typically paying what is called a "control premium"

A control premium simply means that since you will have majority ownership and control over the direction of the company, you are paying a premium to it's current value

Elon offered to buy the shares of Twitter at a 38% premium, which instantly caused the price to increase towards that price per share

How Private Investments Can Make You Rich

When Jack Bogle and Vanguard paved the way for passive index investing, the goal was to provide a passive, low-cost way for the common-man to compound their wealth

Warren Buffett has also famously said that when he dies, his money will be placed in the S&P 500 ETF

Over longer-term time frames, an ETF like the S&P 500 will typically average around 12% returns

There will be time periods of very negative returns, time periods of 0% returns, and time periods of 25% returns

The plan is to take what the market returns, nothing more and nothing less, and be in the market enough years that you can retire comfortably

The problem is this takes a long time, there is no large liquidity event (a big one-time cash payment), and you're most likely not going to generate generational wealth

Private investments like angel investing while a lot higher risk offer massive upside for the risk of getting back $0 - returns like 1,000x your money where $5,000 turns into $5,000,000

The main problem outside the chance of losing all of your money is that the average person doesn't get access to these opportunities

The #1 way to get involved in opportunities like this is by building your personal brand

Whether that's building your personal brand on social media, networking, attending events and meeting cool people working on cool projects

Personally, I have invested in 4-5 private opportunities that all came from offering my time in exchange for investment access, DMing people on Twitter, or just growing my network and connecting with people

It still blows my mind that at 27 I am still seeing new opportunities weekly from various people in my network that include: venture, real estate, businesses, you name it

But once you put a concentrated effort to connect with people, before you know it, opportunities are endless

Tim Ferriss

Many of you I am sure are familiar with Tim Ferriss who wrote the 4 hour workweek and has one of most popular podcasts, The Tim Ferriss Show

Now I don't have personal access to Tim's tax return, but if I had to guess, Tim probably makes $3-5m a year from the various businesses he built via his personal brand

BUT

Tim has a net worth of $100+m

How could that be?

Due to his personal brand, Tim was an angel investor in companies like:

Uber, Facebook, Twitter, Blue Bottle Coffee, Duolingo, Twitter, Shopify and a WHOLE lot more

His investments have had 19 exits

He has angel invested in 40+ companies with a few of them having massive exits via acquisition or IPO

These are the opportunities that not everyone gets access to that can be life changing

Private investments can create generational wealth, with higher risk

Being able to take on some exposure to venture along side your public portfolio is a great way to diversify

What I am doing / not doing

My biggest position still remains the US Dollar $UUP

I am not an active buyer of anything else

While I do still like certain sectors performance based on the macro-economic outlook such Utilities Sector $XLU, Healthcare ETF $PINK

The current level of equity volatility in the market is not investable

Based on the current level of the VIX and the various market dynamics, I am avoiding buying all stocks

So what about bonds?

Typically, when the bond market smells out a recession via slowing GDP growth, bonds will start to be a good buy

However, we haven't hit that point yet, so I am not active buying any fixed income (bonds)

I am sticking with cold hard cash and $UUP bullish US Dollar for now

- Dev

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.