- Capital Contrarian

- Posts

- How do you value a company?

How do you value a company?

Key concepts everyone should have learned...

Email agenda:

Estimated read time: 5 minutes 35 seconds

How do you value a company?

Capital raises vs mergers and acquisitions

Crypto FOMO + my portfolio

Good morning and happy Monday - let's get smarter

How do you value a company?

There are 3 main ways you value a company:

DCF (discounted cash flows)

Public comparables "public comps"

Precedent transactions

This is something everyone should know, but first let me explain an important concept

Opportunity Cost

The time value of money - money today is worth more than money tomorrow

The difference between money today and money tomorrow is opportunity cost

In finance, we call this opportunity cost the discount rate, the opportunity or return % from similar investments/opportunities

Example: If you have have $100k in your bank account, and you're not making any interest on it, but you could invest it in the stock market and make 6% or $106,000, then your opportunity cost is $6,000

Discounted Cash Flows Method

One of the ways we calculate a valuation of a company, is discounting future cash flows by the discount rate, to get the present value of those cash flows

Valuation of an asset = Cash flows / (discount rate - cash flow growth rate)

Most important formula: Cash / (discount rate - cash growth rate)

Here is an example below

We are projecting out a businesses future cash flows and discounting them back to today using the opportunity cost to get a valuation of the business

But what if our company is young and doesn't currently generate cash flows or is losing cash?

There are 2 other common ways to value companies

Public comparables

Precedent transactions

With these two methods, you are looking at the multiples a business is trading at

It could be a multiple of revenue, EBITDA, or various other metrics depending on the industry

You often hear "they're trading at 3x EBITDA" <- 3x is the valuation multiple, EBITDA is the metric the valuation multiple is being applied to

Multiple x metric = valuation

You will frequently hear them called “comps” or “comparables”

Public Comparables Method

For public comparables, you are looking at the valuation multiples for similar (similar in business, size, industry, financials) public companies (public = listed on a stock exchange)

If you were trying to value a private shipping company, you might look at the EBITDA multiple or revenue multiple that FedEx or UPS are valued at to try to see what multiple your company should be valued on

As you can see below, we are taking companies in the leisure space, looking at the Enterprise Value(EV)/EBITDA multiple, and then looking at the low, median, mean, and high, EV/EBITDA multiples to get an idea of what multiple a business be valued on

Side note (will explain more in a future newsletter): For now, just know that enterprise value is the value of the core business operations to both debt and equity holders

I might look at this chart below and see the median EV/EBITDA multiple in leisure is 7x, and know my leisure business has EBITDA of $5m, so my valuation then is 7x EBITDA multiple x $5m EBITDA = $35m valuation

Precedent Transactions Method

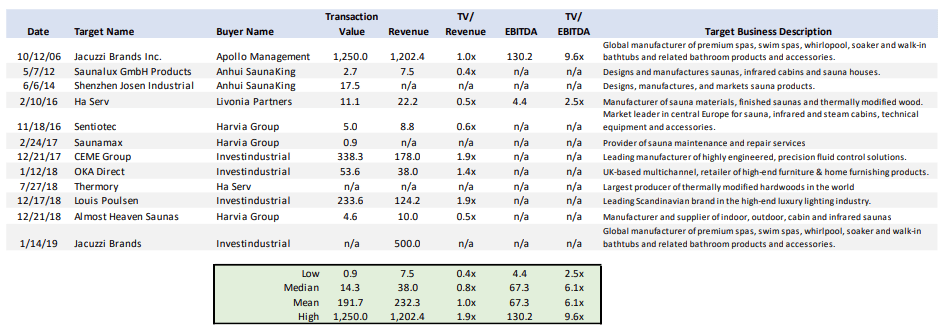

Precedent transactions does the exact same thing as public comparables, looking at the multiples of EV/EBITDA or EV/Revenue, but rather than looking at public companies trading on a stock exchange, you are looking at the multiples of actual past acquisitions in the same industry

Precedent transaction often better than public comparables because there are actual M&A events that have happened recently in the industry, and you are looking to also do M&A, not IPO and become a public company

Ideally, you want an M&A event that has happened in the past 12 months with a company that looks a lot like yours in terms of business, size and financials

As you can see, a very similar looking calculation but instead of enterprise value, you are looking at transaction value, and instead of public companies listed on exchanges, you see the buyer and the seller (target)

Mergers and Acquisitions (M&A) vs Capital Raises

What's the difference between a capital raise and M&A?

Good question, because the premise is very similar - taking money from outside investors

The main difference is mergers and acquisitions are where the company is selling a majority stake in their business, where in a capital raise the company is selling a minority share

Also, in acquisitions it is typically the case that the owners of the business are no longer staying involved, and in capital raises the owners are taking on investors money to grow the business

The valuations and multiples for capital raises are often very different

Why?

If a business is smaller and raising capital, they typically haven’t hit their “hockey stick growth” meaning they expect massive growth in the near future that investors will reap the benefits from

Businesses not looking to raise capital but to sell via M&A are often more mature and already had their massive growth, so they will not get the same multiple that a young growing company will

Example: A young software business with $1m in ARR (annual recurring revenue) may get a 25x ARR multiple, valuing the business at $25m in a capital raise

A more mature software business in the same industry with $5.5m ARR looking to sell a majority interest (M&A event here not a capital raise) may get purchased for a 10x ARR multiple, valuing it at $55m as there is less growth projected due to its size and maturity

There’s a lot less growth upside in a mature business than there is in a smaller business about to explode into the industry, as such, smaller valuation multiples are applied

What I am doing / not doing

My biggest position still remains the US Dollar $UUP

I am a buyer of bonds: $LQD, $BAB

Stocks/Equities: Utilities Sector $XLU, Healthcare ETF $PINK and New Zealand ETF $ENZL

Crypto

As I said last week, Ethereum was starting to look better, and I wanted to see how last week went before I started to buy but....

Not good - not buying Ethereum or any crypto still

Don't have FOMO

When people see crypto go up 10% one day everyone panics that they missed the bottom and buy

Wait for the macro environment that crypto likes to come back, not the one we are in (slowing GDP growth and slowing inflation) before buying

The time for crypto is not now

- Dev

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.