- Capital Contrarian

- Posts

- How to manipulate a stock price

How to manipulate a stock price

*legally*

Email agenda:

Estimated read time: 3 minutes 35 seconds

How to manipulate a stock price

Sell stocks sell crypto

Kim K Capital

Good morning and happy Monday - let's get smarter

How to manipulate a stock price

Incentive compensation is almost always a good thing

If you perform well, you get a bonus

If the company performs well, you get a bigger bonus

Simple and honest, right?

Kinda – but CEOs want you to think so

The truth is, public CEOs often have big bonuses tied to their company’s stock price

So, you’re probably thinking, whats the issue with that? If the company does well, the stock does well, so the the CEO does well

It all sounds gravy

HOWEVER

CEOs have the ability to manipulate their earnings per share (EPS), which can then drive up their stock price

Earnings per share – how much money the company makes / shares outstanding

When a company reports earnings, they will report their EPS

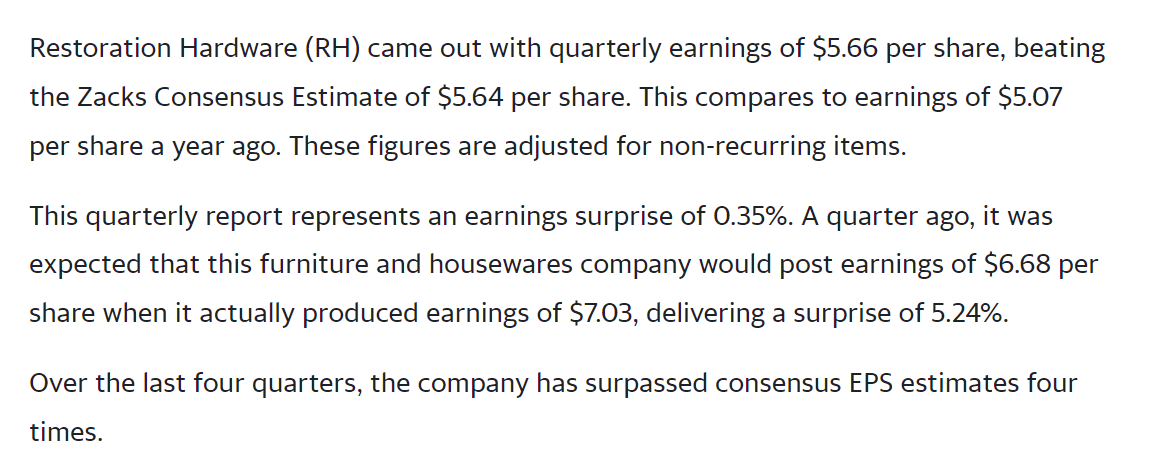

Here's Restoration Hardware's YoY earnings report, and as you can see, they highlight consensus earnings vs actual reported earnings below:

As we have discussed, analysts will project out their earnings target, and the stock will typically do better when they beat analysts per share estimate, and worse

So how can CEO’s manipulate their earnings per share?

By reducing the number of shares outstanding through buybacks

Luckily due to the auditing profession, its hard to manipulate your earnings or the numerator of earnings per share, but you can easily manipulate the denominator, shares outstanding

CEOs can decide that they don’t have any better use of their excess cash or their debt financing, so they are going to buy back shares of their stock from the public

By reducing the number of shares outstanding, they increase their earnings per share

Example: You have earnings of $10 and 2 shares outstanding, or EPS of $5. Now the company buys back 1 share and EPS is now $10

The company uses their balance sheet (cash, debt) to increase their earnings per share, which often helps increase their stock price as they beat earnings, and then this often lets them hit their bonus numbers -----> cha ching $$$

Example below

Since 2009, US companies have spent a record $3.8 trillion on share buy-backs financed by historic levels of debt issuance. Share buybacks are a form of financial alchemy that uses balance sheet debt to make it seem like they are growing, but it's an illusion. A shocking +40% of the earning-per share growth and +30% of the stock market gains since 2009 are from share buy-backs

So the next time a major company says they have to increase costs, or cut expenses due to x y and z because they don’t have the cash, if they have been buying back shares for the past several years or quarters, well then they are full of shit

"If you ask a liar if he’s a liar – he’ll probably lie" – Jay Van Sciver, Industrials Analyst

Markets Markets Markets

Speaking of earnings, we are headed towards an earnings recession for corporations

Companies have slowly been lowering their earnings expectations for Q4 of 2022 and Q1 of 2023

What does this mean?

The rate of change of profits, cash flows, the key metrics that drive up stocks prices are slowing

Companies are going to have to report Q4 of 2022 against their Q4 of 2021 earnings (called YoY comps), and Q4 2021 is the toughest one for them to comp(are) against

So what you should do?

Be an active buyer of $UUP (bullish US dollar), be a buyer of investment grade bonds ($IEF, $LQD), hold cash

Be an active SELLER of stocks and crypto

Hell… even the biggest Bitcoin pumping loser Pomp took any mentions of Bitcoin out of his Twitter bio

If you have stocks in your portfolio that 1. Don’t generate EBITDA or Net Income (cash flow/profits) and or 2. Have high amounts of debt

SELL SELL SELL them on the next bear market rip

The shit stocks cave in first, and profitless high debt shit companies are just that

Kim K Capital

News broke last week that Kim Kardashian is launching a private equity firm, SKKY Partners, with a former partner of one of the largest PE firms in the world, Carlyle

They will be buying e-commerce brands, luxury brands, and hospitality brands

I think this will start becoming a more popular trend

Celebrities who have influence on brands in a niche partnering with finance guys to make investments

The brands they will look to buy will most likely love the idea of having Kim K as an owner which will help them beat out other PE firms bidding

I hope Ray J invests as a limited partner :)

- Dev

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.