- Capital Contrarian

- Posts

- The Consumer is Neck Deep in S***

The Consumer is Neck Deep in S***

Venture's Golden Child Raising a Down Round?

Email agenda:

Estimated read time: 5 minutes 9 seconds

Terrible Consumer Data - Probably Nothing

Venture Golden Child Stipe Raising a Down Round?

Good morning and happy Monday - let's get smarter

Terrible Consumer Data - Probably Nothing

The past few weeks in financial markets have the crypto YOLO call option crowd back on the bull market train

Facebook/Meta has started to come back, and the all tech stock and crypto investors see a light at the end of the tunnel that they BELIEVE is not the train

But it is it?

I think due to age, most millennials only bear market that they can recall is the fast and painful COVID 19 crash

There was no sliver of hope, it was all pain

But - that's not what a typical bear market looks like

This is

There are A LOT of bear market bounces or dead cat bounces as they say throughout a bear market

How can you tell though if we are actually in a bear market bounce or a new bull market?

That's a great question, and I can't say for certain either way. I wish I could.

So, instead of talking about feelings or things I think like 99% of investors and CNBC, I am going to hit you with facts and data that make me worried that these rallies are built on a house of cards

Consumer FACTS & DATA

Consumer credit card balances grew at the fastest rate in the past 20 years in Q4 of 2023

Credit card interest rates are the highest they have been in the past 20 years

Discover's 30+ credit card delinquency rates are the highest in the past 10 year

Consumer's personal saving's was 2.4% in November 2022, which was the 2nd lowest in the past 3 years only behind October 2022 at 2.2%

Food and home costs have brought the real average weekly earnings down by 3% YoY

Of the $3.7 trillion in savings (household deposits), the top 1% have $1.3 trillion and the 90-99th percentile have $1.3 trillion. The bottom 50% of earners have $0.2 trillion....

Both home sales and home prices are accelerating down YoY faster than they have since pre-COVID

Luxury home sales are down 38.4% with non-luxury down 31.4%, while luxury supply is up 5.2%

But but why does the consumer data matter so much?

The consumer's ability to spend is ultimately what drives GDP growth

and if GDP is decelerating, risk assets like stocks and crypto typically do NOT perform well

But more specifically, certain sectors of the economy perform worse than others

An example of a bad sector? Retail

2 of the biggest financial factors that I look at when it becomes to retail businesses are:

Gross margins (sales - cost of goods sold/sales)

CCC (cash conversion cycle)

As I have talked about a lot in previous newsletter's, a businesses gross margin's are extremely important

Gross margin - How much extra profit is there as a percentage after all of the direct costs

The higher the gross margin, the more $ is left to then pay operating expenses (rent, payroll, etc), giving you a higher likelihood of being profitable

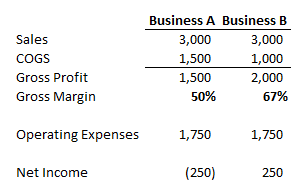

Example below, 2 businesses with the same $ of sales and operating expenses but different COGS -> different gross margin's

It's going to take business A more and more sales volume just to get to the same profit level as business B

In retail, often gross margin's sit between 45-60%

When there is supplier pricing pressure because of inflation, your COGS go up

If your consumer is price inelastic, this means that they will not change their purchasing based on price changes

But if your customer is price elastic, you may not be able to charge them more which ends up bringing down your gross margin and putting pressure on the business

This is why when the consumer is in a tough position and inflation/pricing pressure is on, retail businesses have trouble via declining gross margins

Cash Conversion Cycle

For the accounting and finance nerds out there, the cash conversion cycle formula is DSO (days sales outstanding) + DIO (days inventory outstanding) - DPO (days payable outstanding)

In English - this metric looks at how long it takes a company's investment in inventory into sales

If you are purchasing inventory but not converting those into sales, then cash, to pay for more inventory, you can be in a big cash crunch

As you can see from the chart below from Hedgeye Risk Management, there's a massive spread between retail sales and inventory and that's what we like to call extremely not good

There is a lot of headwinds over the next 3-6 months that are making me social distance from any retail names in the market

Venture Golden Child Stipe Raising a Down Round?

Stripe has long been known as the golden child of venture

Why?

Because in 2021, the company raised at the highest valuation for a private company ever

If you are a venture capital investor that invested $1m in their seed round at $20m valuation

Not counting dilution (new investment rounds would lower your ownership if you didn't keep investing so the actual seed returns on the $1m are likely much lower than this) that investment would have be worth $4.78 billion...

The benefit of being a public is you are able to more easily issue shares aka get access to cash (liquidity) when you need it

Per Techcrunch, Stripe is looking to raise at least $2 billion at a $60 billion valuation

If one of the fastest growing and largest private companies in the world has to raise at a down round (lower valuation than their previous financing), it sure as hell means so will most other private companies and that valuations are still compressing

What's very interesting is Stripe isn't raising the round to cover operating expenses, they are actually raising the $2 billion to cover taxes associated with issuing stock units to employees

When in doubt, the fed raises interest rates to bring down ridiculous valuations and then Uncle Sam comes in to collect taxes bringing down valuations a little bit more

Down rounds have been more and more common, but I think that it will still continue through a good amount of 2023 as we see GDP slow more and more

Dev

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.