- Capital Contrarian

- Posts

- Big Tech Big Bets ($70 BILLION)

Big Tech Big Bets ($70 BILLION)

and why debt is good, not bad

Email agenda:

Estimated read time: 5 minutes 35 seconds

Big Tech Big Bets

Why Debt is So Powerful

What I am doing / not doing

Good morning and happy Monday - let's get smarter

Big Tech Big Bets

Last week some of the largest corporations in the world reported their earnings

As expected and as highlighted on Friday, they were, a technical term, DOGSHIT

Microsoft reported the slowest growth in 5 years

Amazon guided (insight into the next quarter) down revenues for Q4

Meta guided down on slowing advertising spend

Alphabet reported YoY earnings down 27%

This is what happens when you have a slowing economy or the dreaded R-word, recession

The real key is to understand that the biggest companies in the world can't hide from economic gravity

In the US we currently have:

Slowing GDP

All-time low consumer confidence

Sticky inflation hurting the consumer

Credit card balances at all-time highs

This is not oil, a meme stock or even a shitcoin. It’s credit card debt in America.

— Genevieve Roch-Decter, CFA (@GRDecter)

4:25 PM • Oct 30, 2022

The consumer is spending less money, so companies are making less money, so companies are reducing expenses where they can on things such as employees (overhead), advertising, etc

That is definitely not rocket science

When the US economy starts to accelerate, likely in Q3 of 2023, tech will be booming again

But the question becomes, which tech do you bet on next year?

You have to look at where they are placing their bets and how much

WHERE -> If you read the 10Q, management will discuss where they are placing their bets

From Amazon's 10Q:

There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets

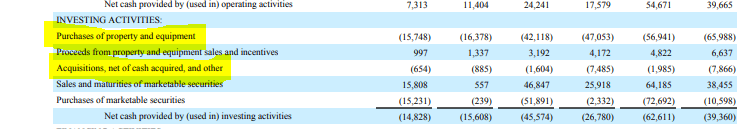

HOW MUCH -> in the investing section of the cash flow statement, you can see their outflows of cash on longer-term projects

These companies have to take their cash and decide what projects to invest in thinking out into the future, knowing that it could be 4-8 years before those assets generate a return

A great metric to analyze companies is ROA (Return on Assets)

Wall St Mojo

Return on assets - what is the return you are getting for all of the projects you are betting on?

Big Bets

AMAZON

When people think of Amazon, they think of the retailer

They think of buying all of their crap with the click of a button and it arriving at your house tomorrow

When I was at KPMG, I heard a partner use a line that has stuck with me forever: "You can have things done fast, cheap, and right. But you can only pick 2 of the 3"

Amazon for the consumer is all 3

And while I absolute love Amazon and getting things for cheap and fast, it's not the best business model unless done at massive massive amounts of volume (which they have achieved)

But - not many people realize that 74% of Amazon's profits in 2021 (18.5 of the 24 billion), came from Amazon Web Services, their cloud computing operation

Amazon is a tech play

Amazon took a huge bet investing in this project a few years back, and this bet was an absolute homerun for the business

META

Meta and the metaverse

Meta has currently invested $70 BILLION into the metaverse

I am not a metaverse expert, but the question becomes when you think of investing in tech, specifically Meta down the road, do you believe they will get a return on this asset?

The company will continue to make money from their advertising platform, but for them to continue to grow and to keep pace with the other corporate giants, they need this bet to work out and to get a return on this asset, or Meta could go much much lower

Zuck said he thinks it will be 8 years before they get a return on this investment

So - do you believe in Meta's big bet or not?

Understanding the cash flow statement and what assets the company is investing in either internally or through M&A will tell you a lot about the future growth and success of the company

Why Use Debt?

One of the unfortunate things about school is the bad connotation that comes with the word debt

Even hearing it still makes people's (mine) stomach flip

But the truth is, that using debt (leverage) is a powerful tool when used correctly

Using debt to buy a car (a liability) you can't afford = bad and dumb debt

Using debt to buy an asset (investment property) = good debt

See the best thing about debt is that you get to use someone else's money (the banks) to make you money and that amount is for the most part, fixed

Interest, is also tax deductible

When you take on investors for a project, they get equity

Paying out dividends to equity holders is NOT tax deductible

Equity scales as the business scales

Here's a perfect example of why debt is cheaper than equity

If someone gives you $1m to start a business at a valuation of $10m, they own 10%

If 5 years from now that business sells for $100m (holding all else constant), that person's $1m just turned into $10m, so your $100m sale gets you $90m and they get $10m

If you took on debt of $1m at 5% interest rate, you'd have to pay back the principal of $1m and $50k in interest per year for 5 years

The debt doesn't scale like equity, so you're now paying back the $1m and $250k of interest or $1.25m rather than $10m

That $100m sale using debt just kept an additional $8.75m for you

You also get to deduct all of your interest payments on your tax return - another added bonus

Debt is a powerful tool if you understand it and used correctly

What I am doing / not doing

My biggest position still remains the US Dollar $UUP

Volatility in the market remains high (VIX close to 26)

When the VIX is in the 20's there isn't much in terms of equities (stocks) that I am a buyer of

When VIX is in the 30's I am not touching equity exposure at ALL

The GDP outlook combined with currently volatility = not much to be buying for me

- Dev

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.